Valuing AMSC ASA

The maritime sector’s recent mergers and acquisitions wave creates intriguing valuation gaps among companies with cross-shareholdings–for example: AMSC ASA (“AMSC”) and Solstad Maritime Holding AS (“Solstad Maritime”).

In January 2024, Oslo-listed AMSC sold its only ship in exchange for shares in private offshore vessel company Solstad Maritime.

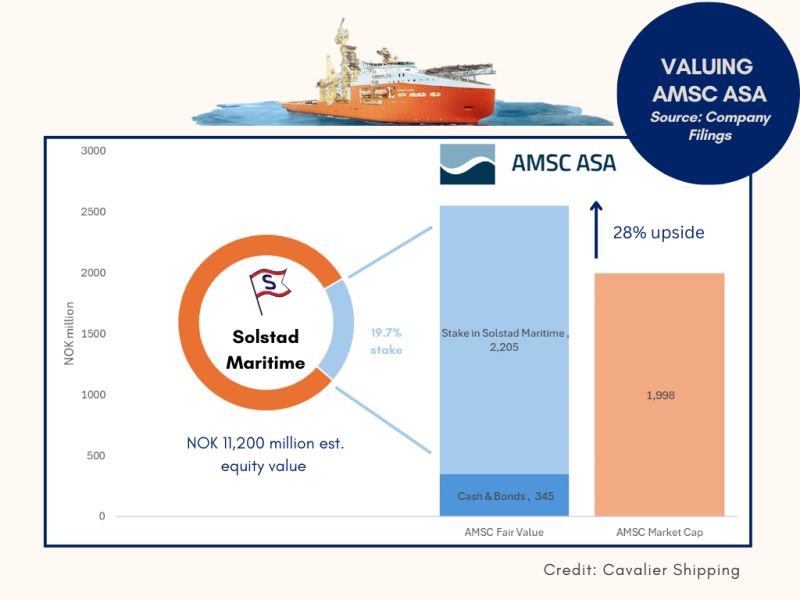

AMSC’s 19.7% stake in Solstad Maritime is a crucial part of its balance sheet, so the company’s fair value hinges on Solstad Maritime’s valuation.

By the end of 2024, Solstad Maritime should generate NOK 3.3-3.5 billion in earnings before interest taxes and depreciation (EBITDA).

Publicly-listed sister company, Solstad Offshore ASA, trades at an enterprise value (EV) to EBITDA multiple of 5.2x, giving Solstad Maritime a current EV of ~NOK 17.7 billion and an equity value of ~NOK 11.2 billion after deducting Solstad Maritime’s ~NOK 6.5 billion of net debt.

Based on these figures, AMSC:

Holds ~NOK 2.2 billion value in its 19.7% stake in Solstad Maritime.

Has a total fair value of ~NOK 2.6 billion, including its bond portfolio and cash, implying a 28% upside from its current share price of NOK 27.80 and market capitalization of ~NOK 2.0 billion.

However, the days are seemingly numbered for this valuation gap between AMSC and Solstad Maritime, with Solstad Maritime’s plans to go public by June 2025.

Solstad Maritime’s share price listing will directly clarify the market value of AMSC’s holding—eliminating the need for estimations like mine and allowing AMSC’s shares to trade closer to their fair value.

Disclosure: I am a shareholder of AMSC ASA. This post is for informational purposes only and should not be construed as investment advice.