Posts

Cavalier Shipping insights on the current shipping finance market and recent events in the shipping space.

Join us on Substack to get posts delivered directly to your inbox.

BDRY: A Valuation Unicorn Among Public Dry Bulk Shipping Stocks

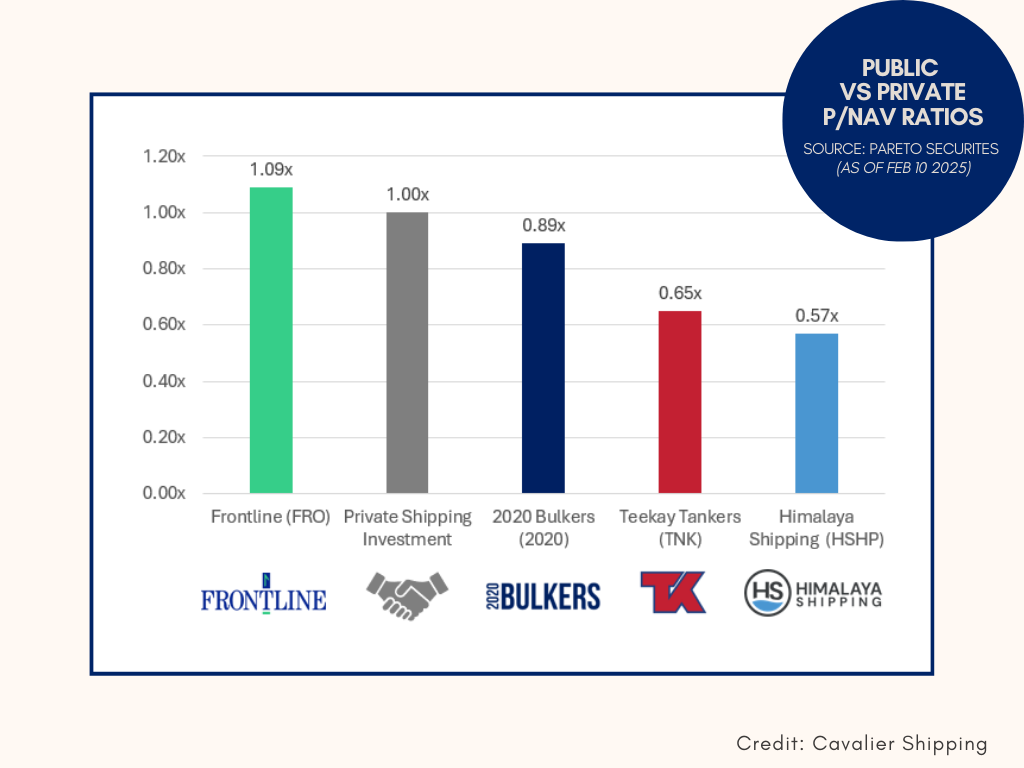

Unlike most publicly-listed dry bulk shipping companies, the Breakwave Advisors Dry Bulk Shipping ETF (BDRY) trades at a slight premium. Public dry bulk shipping companies on average trade at a 25% discount to their net asset value (NAV) yet BDRY stays close to its NAV. How can this be?

Comparing Public and Private Shipping Company Valuations

Public shipping companies’ end valuations are far more variable than private shipping companies’, since the latter group doesn’t have the constant mark-to-market pricing mechanism of public markets–P/NAV–as a factor.

Shipping’s Illiquidity Premium

Is a 2% premium enough for investors to restrict their ability to quickly exit their bets in order to take profit (or minimize losses)?

Shipping Market Timing is Everything

When buying low and selling high account for the majority of returns in an investment, market timing is everything.

Re-post: ‘Not all equal’: Why Aristides Pittas’ latest spin-off could actually work for investors

Earlier this week, I sat down with Joe Brady of TradeWinds to discuss the recent Euroseas Ltd. spinoff and our thoughts at Cavalier Shipping.

Contextualizing Shipping Investment Returns

What is the average yearly return on a shipping investment? A decade after I was first asked this question, I’ve decided to do the math myself.

Euroseas/EuroDry 2018 Spin-off: Repeatable?

A basic corporate valuation principle: the day after a company pays a dividend, the valuation of the company will decrease by the amount of the dividend (whether paid in cash or stock).

Yet, the conventional corporate finance rules don’t often apply to public shipping companies—take the 2018 Euroseas Ltd. spin off ofEuroDry Ltd., for example.

Greek Shipping Company Spin-Offs

Last week Euroseas Ltd. (ESEA), led by Aristides Pittas, announced its intention to spin off three vintage container ships into new company Euroholdings at the end of the month.

Funding VLCC Newbuilds: Bruton Ltd

Let’s say you ordered a pair of newbuilding dual-fuel Very Large Crude Carriers (VLCCs). How would you fund their construction costs?

Shipping Representation in the Market

Contrast shipping’s 0% representation in the U.S. S&P 500 with its 12% representation in Norway’s Oslo Børs Benchmark Index––in the U.S., professionals often confuse "shipping" with logistics giants like FedEx or UPS; in Norway, professionals are immersed in the maritime world, with financial media regularly covering shipping and offshore markets.

Panamax vs. Supramax Earnings

Bigger ships with greater cargo capacity earn more than smaller ships with less capacity for carrying the same type of cargo, right? [Wrong.]

The Ripple Effects of Earnings Volatility

The ripple effect of a sharp 45% drop in Capesize bulk carrier earnings this October is reverberating across the dry bulk universe.

Infrastructure in Shipping

Major infrastructure funds invested big dollars in shipping in recent years. But what qualifies as "infrastructure" within shipping? LNG assets, container leasing, and Jones Act assets.

Shipping + Broader Investment Trends

When you think of mainstream investment categories, things like tech and real estate come to mind–not shipping. But decisions to allocate capital into shipping are often deeply intertwined with broader investment trends.

Shipping vs. Hedge Funds: Net Asset Values

Publicly-listed ship owners often trade at a discount to their net asset value (“NAV”): the cash amount a company would net if it were to sell all of its assets and use the proceeds to pay off all of its liabilities.

Shipping’s Quintessential Investing Strategy

Shipping’s quintessential investing strategy: buy at the trough and sell at the peak of a cycle. But what do you do if nothing is trading at or near a trough? This question vexes shipping-focused investors today.