Panamax vs. Supramax Earnings

Bigger ships with greater cargo capacity earn more than smaller ships with less capacity for carrying the same type of cargo, right? [Wrong.]

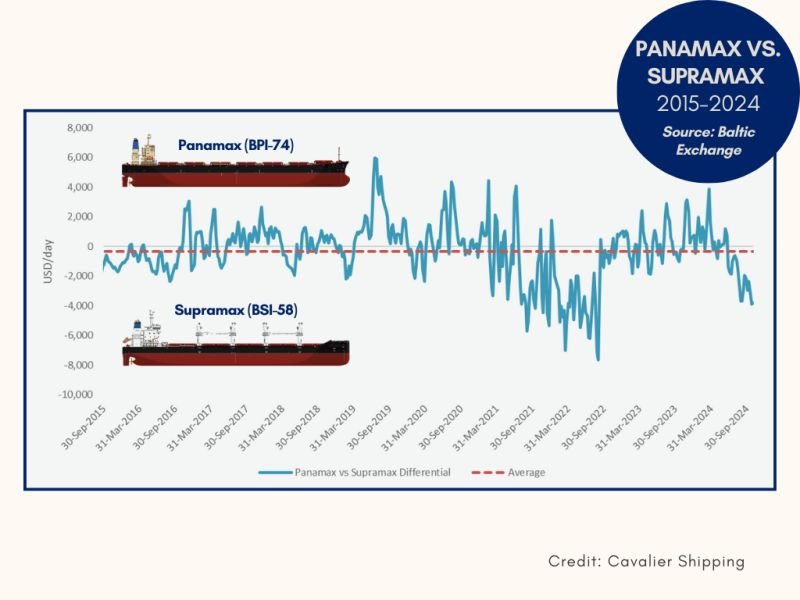

Supramaxes, with deadweight tonnage of 58,000 tons, have out-earned larger Panamax bulk carriers, with deadweight tonnage of 74,000 tons, since late June 2024–and this counter-intuitive market dynamic is not a one-off occurrence.

Since mid-2015, the Baltic Supramax Index has earned more than the Baltic Panamax Index by an average of >$300/day (Baltic Exchange).

Panamax operating costs are ~$300/day higher than those of a Supramax, giving Supramaxes an operating cash flow advantage of about $600/day from mid-2015 to present.

Panamaxes, on average, have purchase prices that are ~$3 million more than Supramaxes.

According to the Efficient Market Hypothesis, prices should reflect all available information, meaning the only way to earn higher returns is to take greater risks. Clearly, this hypothesis does not hold true in dry bulk shipping.