Posts

Cavalier Shipping insights on the current shipping finance market and recent events in the shipping space.

Join us on Substack to get posts delivered directly to your inbox.

Panamax vs. Supramax Earnings

Bigger ships with greater cargo capacity earn more than smaller ships with less capacity for carrying the same type of cargo, right? [Wrong.]

Panamax Earnings Vs. Values

A core tenet of valuation theory: the price of an asset is the net present value of the cash flows it generates…unless that asset is a ship.

Vessel Sales and the Summer Slump

Just as stock market liquidity dries up on Wall Street over the summer, with traders and hedge fund managers heading to the beach, sale and purchase activity of vessels dwindles as shipowners take some deserved time off.

Shipping + Broader Investment Trends

When you think of mainstream investment categories, things like tech and real estate come to mind–not shipping. But decisions to allocate capital into shipping are often deeply intertwined with broader investment trends.

Shipping vs. Hedge Funds: Net Asset Values

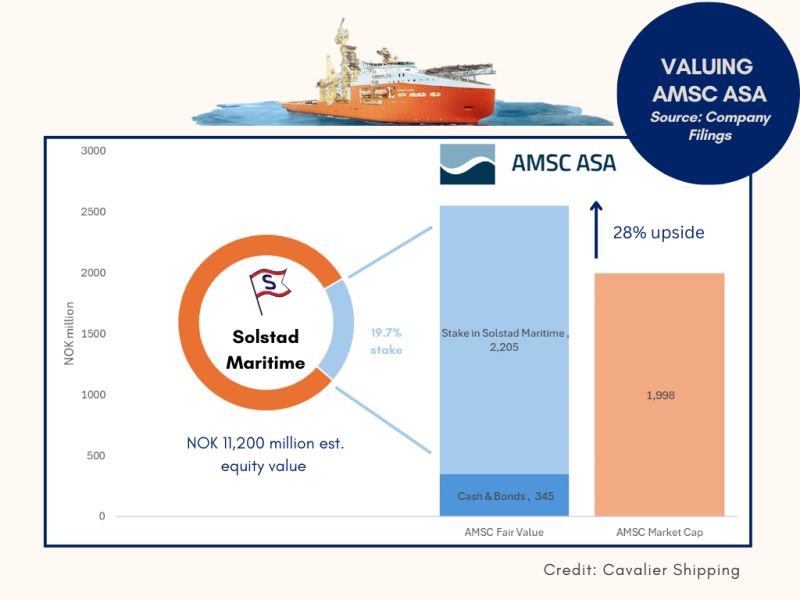

Publicly-listed ship owners often trade at a discount to their net asset value (“NAV”): the cash amount a company would net if it were to sell all of its assets and use the proceeds to pay off all of its liabilities.

Shipping’s Quintessential Investing Strategy

Shipping’s quintessential investing strategy: buy at the trough and sell at the peak of a cycle. But what do you do if nothing is trading at or near a trough? This question vexes shipping-focused investors today.

Connecticut/New York Shipping: Changing Financial Tides

The Connecticut/New York area’s competitive advantage on the world maritime stage does not stem from the tradition of fleets passed down from generation to generation, as you would find in Greece. The region's superpower is its proximity to some of the deepest pools of capital in the world—the "smart money".

“Alternative” Ship Finance Landscape Growth

The "alternative" ship finance landscape has matured considerably over the past five years. One example of the landscape's shifting dynamics: the change in the nature of the deals that are getting done.