“Alternative” Ship Finance Landscape Growth

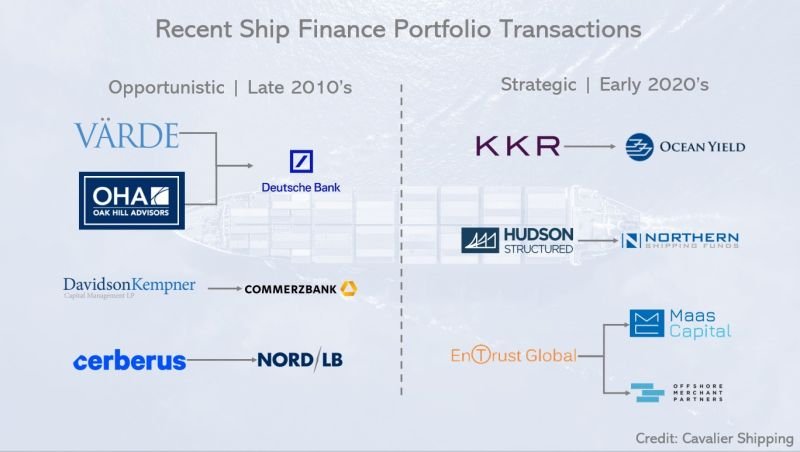

The "alternative" ship finance landscape has matured considerably over the past five years. One example of the landscape's shifting dynamics: the change in the nature of the deals that are getting done.

Late 2010s | Opportunistic acquisitions of non-performing loan portfolios at steep discounts from European banks that were retreating from the sector.

Oak Hill Advisors, L.P. and Värde Partners purchased $1 billion of non-performing shipping loans from Deutsche Bank in 2018.

Davidson Kempner Capital Management bought $355 million of loans from Commerzbank AG in 2019, as part of the bank's withdrawal from the shipping sector.

Cerberus Capital Management bought a EUR 2.6 billion non-performing shipping loan portfolio from NORD/LB in 2019.

Early 2020s | Strategic acquisitions of ongoing business units and performing portfolios at prices closer to (and in come cases in excess of) their book value.

KKR successfully took Ocean Yield AS private for $829 million in 2021.

Hudson Structured Capital Management Ltd. acquired Northern Shipping Fund Management LLC in 2022.

EnTrust Global purchased Maas Capital in 2021 and then OMP Capital AS in 2024.