China’s VLCC Market Insight

Only one of the following statements can be true:

We are on the verge of an upswing in the VLCC market.

A major Chinese state-owned oil company will lose money on their latest fixtures.

PetroChina International affiliate Glasford Shipping reportedly has fixed one-year time charters at:

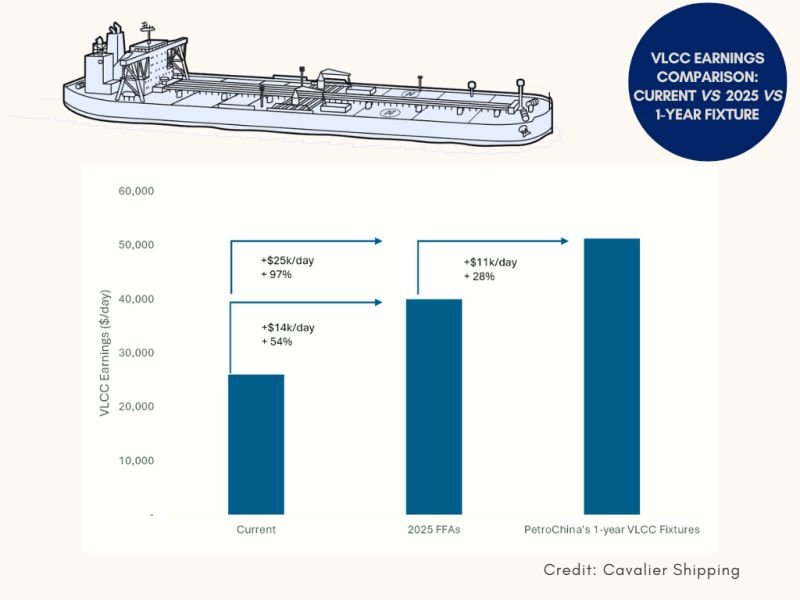

$55k/day for the DHT Lion; and

$47k/day for the FPMC C Noble.

Compare this with VLCC earnings of ~$26k/day as of 9/6/2024 and ~$40k/day for 2025 FFA contracts.

China represents 25% of global seaborne crude oil trade–or ~10 million barrels/day of the ~40 million barrels/day global total. As a subsidiary of the major Chinese state-owned oil and gas company China National Petroleum Corporation, PetroChina should have better insight on projected import demand from this crucial market than others.

For those looking to bet on the tanker market, going long the TD3C FFAs presents an interesting opportunity to take the same stance as an informed market player like PetroChina–but at a discounted entry price.

If you need assistance in expressing your market views through shipping’s underappreciated derivatives market, please don’t hesitate to drop me a line.