Posts

Cavalier Shipping insights on the current shipping finance market and recent events in the shipping space.

Join us on Substack to get posts delivered directly to your inbox.

BDRY: A Valuation Unicorn Among Public Dry Bulk Shipping Stocks

Unlike most publicly-listed dry bulk shipping companies, the Breakwave Advisors Dry Bulk Shipping ETF (BDRY) trades at a slight premium. Public dry bulk shipping companies on average trade at a 25% discount to their net asset value (NAV) yet BDRY stays close to its NAV. How can this be?

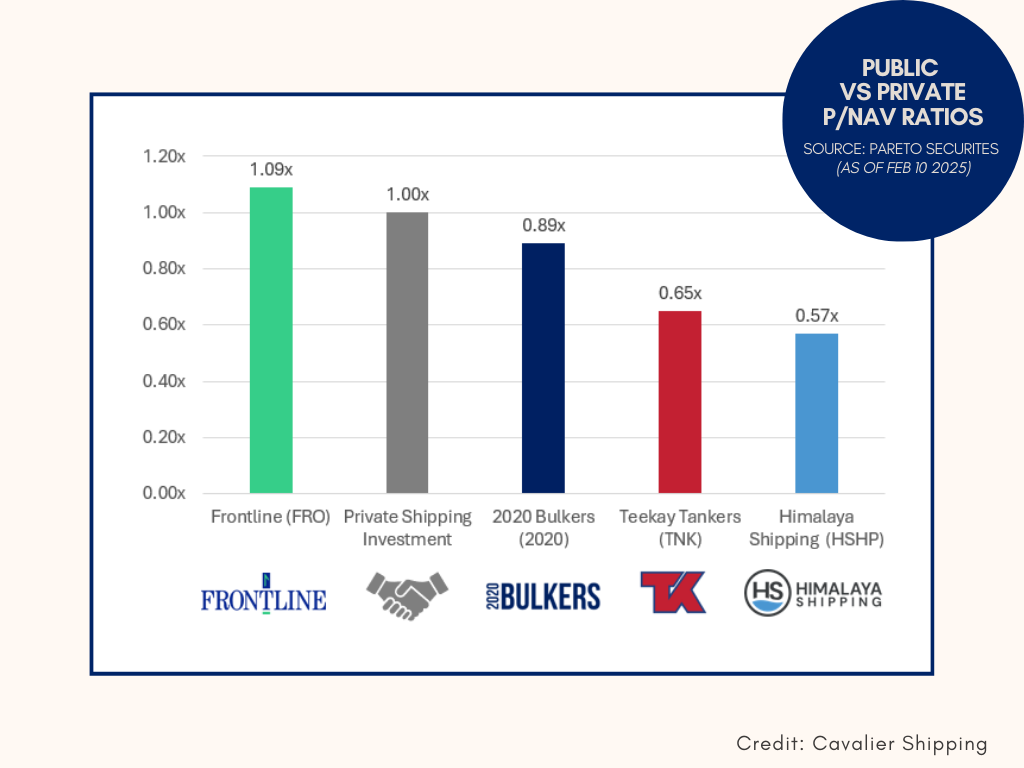

Comparing Public and Private Shipping Company Valuations

Public shipping companies’ end valuations are far more variable than private shipping companies’, since the latter group doesn’t have the constant mark-to-market pricing mechanism of public markets–P/NAV–as a factor.

Shipping’s Illiquidity Premium

Is a 2% premium enough for investors to restrict their ability to quickly exit their bets in order to take profit (or minimize losses)?

The Jones Act Parallel Market

One man’s trash is another man’s … Jones Act-qualified LNG carrier?

Shipping Representation in the Market

Contrast shipping’s 0% representation in the U.S. S&P 500 with its 12% representation in Norway’s Oslo Børs Benchmark Index––in the U.S., professionals often confuse "shipping" with logistics giants like FedEx or UPS; in Norway, professionals are immersed in the maritime world, with financial media regularly covering shipping and offshore markets.

Freight Forward Agreements + Liquidity

“Is the FFA market liquid enough?” It’s one of the most common questions about Forward Freight Agreements (FFAs). Like many things, the answer is: it depends.

The Ripple Effects of Earnings Volatility

The ripple effect of a sharp 45% drop in Capesize bulk carrier earnings this October is reverberating across the dry bulk universe.

Charter Rates for Very Large Crude Carriers

In today’s broad bull market for shipping, most segments are at cyclically high levels, so it’s difficult to identify attractive entry points to invest. A needle in the haystack: VLCC charter rates.