Posts

Cavalier Shipping insights on the current shipping finance market and recent events in the shipping space.

Join us on Substack to get posts delivered directly to your inbox.

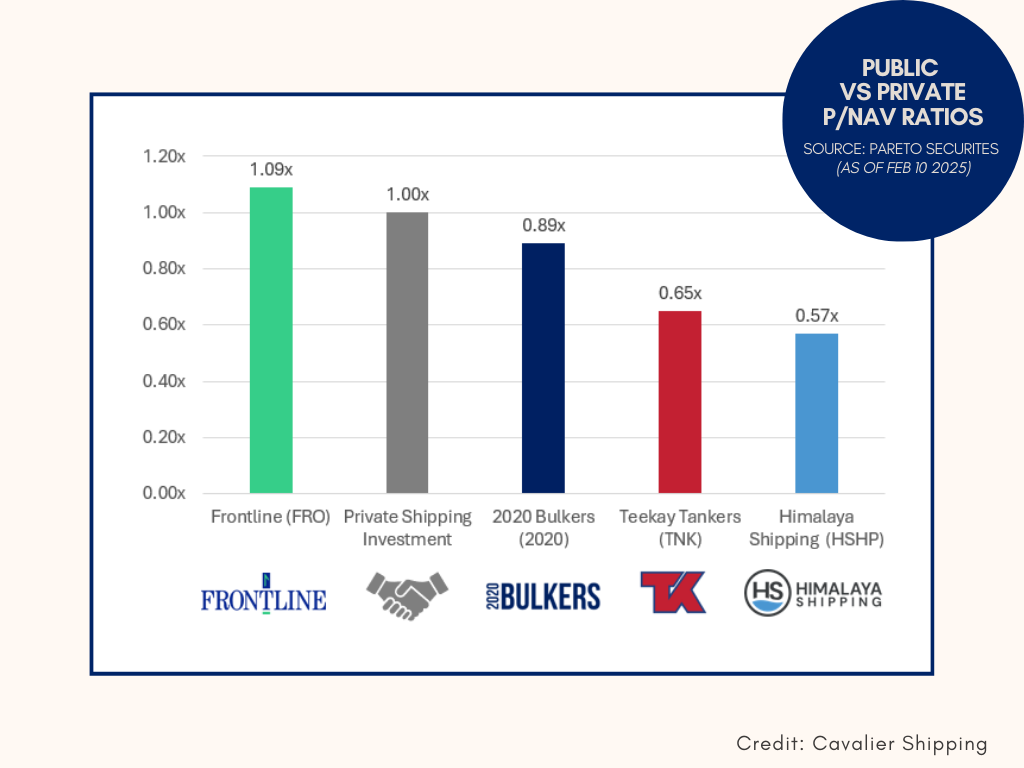

Comparing Public and Private Shipping Company Valuations

Public shipping companies’ end valuations are far more variable than private shipping companies’, since the latter group doesn’t have the constant mark-to-market pricing mechanism of public markets–P/NAV–as a factor.

Re-post: ‘Not all equal’: Why Aristides Pittas’ latest spin-off could actually work for investors

Earlier this week, I sat down with Joe Brady of TradeWinds to discuss the recent Euroseas Ltd. spinoff and our thoughts at Cavalier Shipping.

Euroseas/EuroDry 2018 Spin-off: Repeatable?

A basic corporate valuation principle: the day after a company pays a dividend, the valuation of the company will decrease by the amount of the dividend (whether paid in cash or stock).

Yet, the conventional corporate finance rules don’t often apply to public shipping companies—take the 2018 Euroseas Ltd. spin off ofEuroDry Ltd., for example.

Greek Shipping Company Spin-Offs

Last week Euroseas Ltd. (ESEA), led by Aristides Pittas, announced its intention to spin off three vintage container ships into new company Euroholdings at the end of the month.